Economics_RS Class 08

A BRIEF OVERVIEW OF THE PREVIOUS CLASS (05:03 PM)

BOND MATURITY and BOND YIELD (05:07 PM)

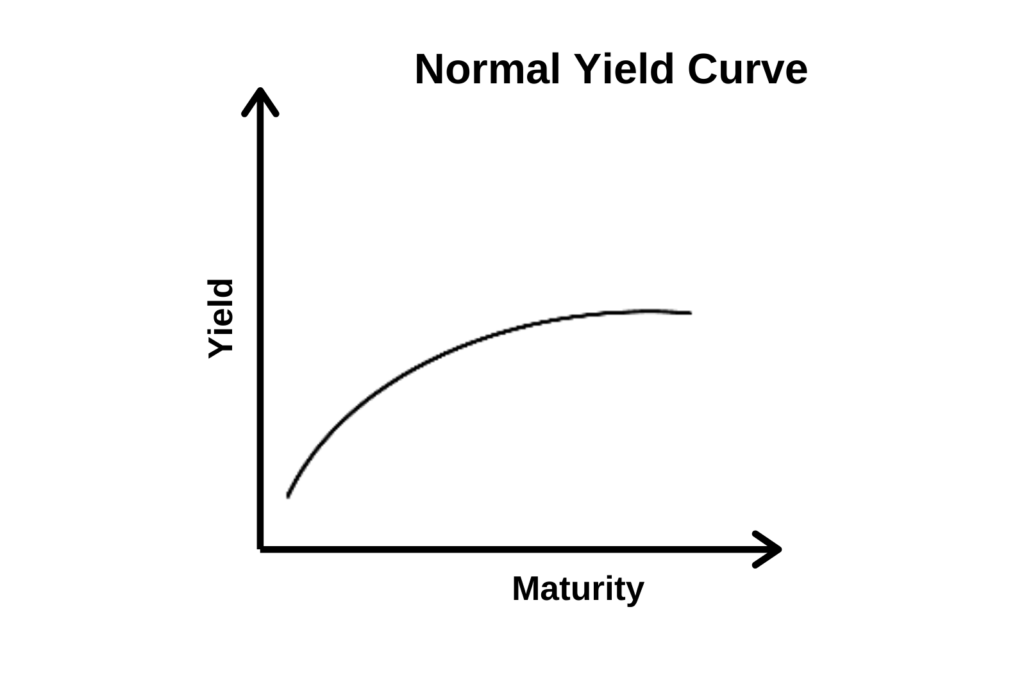

- In general, Long term Bonds have a higher yield

- During COVID, the demand was falling, consumption was falling and job loss was there.

- Objective- Reduction in the REPO rate should lead to a reduction in interest rates so that banks can give cheap loans.

- But there was inappropriate monetary transmission [Monetary policy gets transmitted to interest rate ]

- Operation Twist

- Long terms should become cheaper. Examples- Motorcycle, car loan, Home loan.

- For a person who is taking a loan, the yield should be less i.e. Interest rate should be less. [* For a loan taker, A bond having a bond price of 100 and a coupon of 10 is better than a bond price of 90 and a coupon of 10].

- If the bond yield has increased to 11.1% from 10% then if someone wants to raise new loans then one has to offer higher returns. Thus loans will become costlier.

- Long-term loans are offering higher yields which means it is offering more interest. So RBI wants to decrease this interest rate. RBI through a mechanical process tries to decrease the yield of long-term bonds.

- To reduce the yield, the bond price should increase.

- To increase the bond prices of the long-term bonds then there should be more demand for these bonds and RBI will create a shortage by Buying the long-term bonds.

- When RBI is buying, then Bonds are moving into RBI and RBI is injecting the money.

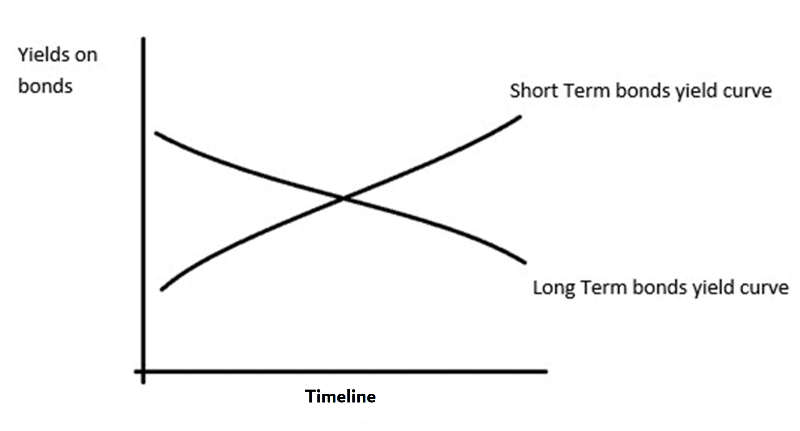

- RBI simultaneously sells short-term bonds.

- By selling short-term bonds and buying long-term bonds, RBI will change the interest rate.

- Operation twist (05:36 PM)

- Selling short-term and Buying long-term bonds simultaneously to make long-term loans cheaper.

- Operation Twist was first used by the USA

- Monetary transmission

- It refers to the process by which a central bank's monetary policy decisions are passed on through the Financial market to businesses and households i.e. it is nothing but the REPO rate change that should get reflected in the Bank's interest rate policies.

- In 1994, RBI announced the landmark decision to fully de-regulate interest rates on advances above 2 lakhs. Since then RBI introduced 4 benchmarks lending rates for proper pricing of loans and transmission of interest rates.

MONETARY TRANSMISSION MECHANISM (05:43 PM)

- Initially, there was Benchmark prime lending rate, the base rate in 2010, MCLR in 2016, and External Benchmarking.

- Internal benchmark lending rate

- IBLR is a set of lending rates that are calculated after considering factors like the Bank's financial situation, Deposits (Deposit rate), NPAs, etc.

- Prime lending rates, Base rates, and MCLR are all examples of internal benchmark lending rates.

- Benchmark Prime lending rates, PLR-

- It is used as a benchmark rate for lending till June 2010.

- Under BPLR, banks loans were priced based on the actual cost of Funds however, BPLR resulted in an opaque system as the bulk of wholesale credit (Loans to corporate customers) was given at sub-BPLR rate and wholesale credit comprises nearly 70% of the bank's credit.

- Under this system, Banks were subsidizing corporate loans by charging higher interest rates on retail and Small& medium enterprises.

- It is the interest rate offered to the prime lenders. [* Prime customers= Wholesale customers= companies. ]

- Overdependence on Prime customers is risky. Also, retail customers were losing out because of the prime lending rate. So the RBI decided to change it to Base Rate in 2010.

- Cost of funds (06:10 PM)

- Banks will incur some costs for arranging the funds. Banks are incurring costs by maintaining CRR (Hidden cost) and, by doing REPO operations (getting loans from RBI).

- For example- The average cost of arranging funds in the last 2 years will be 9% (Assuming, In 1st year - 10%, and in the second year- 8%).

- This impacts the interest charged by the banks while giving loans.

- If the cost of arranging the funds will increase then the Interest rate will also increase.

- In BPLR, corporates were getting benefitted while retail customers were losing out.

- When RBI is decreasing the REPO rate then it means the cost of arranging the funds is decreasing, then it was an expectation that banks also reduce the interest rate. Thus further increases in the money supply and growth may occur.

- Though REPO rates were reduced, banks were not changing the BPLR. [* Lack of monetary transmission].

- Banks arguments

- Banks take the average cost of funds and not the actual cost.

- Banks also take the maintenance of CRR into consideration.

- Banks also take the profitability of the Bank, If NPAs are more then Banks may not decrease the lending rate when RBI decreases the REPO rate.

- RBI was saying that with the fall of the REPO rate the bank's average cost should also be declining.

- Base Rate (06:29 PM)

- Loans taken between June 2010 and April 2016 were based on a base rate system.

- It is the interest rate below which banks should not give loans (Agricultural loans are exempted from the Base rate system).

- It is calculated based on different parameters like

- a) Average cost of funds

- b) Profit margin

- c) Operating expenses

- d) Cost of maintaining CRR etc

- Base rates depend on the above factors and therefore each bank has a different base rate.

- Banks logic

- Banks were not changing the base rate every month. Every two months, there is a bi-monthly MPC review report. Banks were changing it after a delay (4 or 6 months) and they were not taking the immediate change but the average cost.

- Banks profitability- NPAs were increasing because of the Twin balance sheet problem.

- [* Twin Balance sheet problem- Corporate balance sheet (they were affected and making losses) + Banks became hesitant in giving loans. This was seen from 2008-2013.]

- Banks were also saying about Double financial repression i.e. financially repressed on both the Liability side as well as Asset side.

- CRR was reducing the capacity of giving loans, and SLR was also creating problems on the asset side. On the asset side, the banks were given targets such as Priority sector lending (MSME, Agriculture, Education, and Health sectors need to be given loans at a lesser interest ).

- As per RBI targets, 40% of loans were given to PSL. The banks were losing the margins.

- Also Loan waivers given by the government were eroding the asset side of the banks.

- On the liability side, the banks were also having problems as Government was parallelly running some schemes such as Sukanya Samriddhi Yojana (It was giving 8%). This was discouraging the depositors.

- Also, Banks were arguing that it has to give more interest on deposits also.

- Failure of transmission (06:51 PM)

- Base rate system did not lead to monetary transmission due to reasons like

- a) Base rate was not changed every month leading to improper monetary transmission.

- b) REPO rate is not directly reflected in the formula.

- c) Banks were stating reasons like Twin Balance sheet syndrome, Asset-liability mismatch, continuous increases in NPAs after 2011, Double financial repression, etc.

- Twin balance sheet syndrome- Corporate balance sheet affecting the bank's balance sheet and banks balance sheet affecting the corporate balance sheet.

- Double financial repression- Financial repression from both sides (Asset and liability side).

MCLR RATE (Marginal Cost of Funds Based Landing Rate) (07:12 PM)

- It is the benchmark interest rate below which banks should not give loans. MCLR superseded the previous base rate system in determining commercial bank lending rates. MCLR uses factors like

- a) Marginal cost of funds

- b) Operating costs

- c) Carry cost of CRR

- d) Tenor premium- It is the premium charged on long-term loans in order to minimize the risk of term lending.

- If banks are giving loans for 3 years, the interest rate was 7%. In between this time period may vary, For example- if the loan is paid in 7 years then the rate will be increased

- Marginal cost of funds- It is the additional or incremental cost incurred by banks to arrange new funds.

- Reasons for introducing MCLR

- a) Increasing transparency in the bank's interest rate calculation.

- b) Ensuring monetary transmission

- c) To assist banks in becoming more efficient and profitable in the long run as well as contribute to economic development.

- d) To make lending available at rates that are fair to both lenders and borrowers.

EXTERNAL BENCHMARK LENDING RATE (07:33 PM)

- To ensure complete transparency RBI mandated the banks to adopt a uniform benchmark within a loan category effective from 1st October 2019.

- Unlike MCLR, which was an internal system (IBLR), RBI offered banks 4 options with respect to external benchmarking

- a) RBI's REPO rate

- [* When there is federal tightening in the USA i.e. rising interest rates in the USA then it means bond yields are high and loans will become costly. FII who has invested in India will sell the bonds and will buy the USA bonds. This will lead to a flight of capital.

- Federal tightening means dollar supply is less, leading to dollar demand being on the higher side. This will lead to the depreciation of the rupee and imports will costly. When the price of oil, food, and fertilizer will increase thus causing inflation (Cost-push inflation).

- Then in India, MPC will look into the options and may not think of reducing the REPO as it may lead to more inflation (demand-pull inflation) ]

- b) 91 days Treasury Bills/ T-Bills

- c) 182 days Treasury Bills

- d) Any other benchmark market interest rate as developed by the financial benchmark India private limited.

- Treasury Bills (07:49 PM)

- Through G-sec is borrowing for a long-term period.

- For raising money for a short-term period

- [* Financial market- Money market (For short term i.e. less than one year- Debt market) and Capital market (long term- Debt instrument, equity instrument)]

- T-Bills/ Treasury Bills- Using these instrument government can take a loan for a period of less than one year (91 days T bill, 182 days T Bill, 364 days T Bill).

- 14 days T-Bill is now not there.

- T-Bills can also be made part of SLR.

- T-Bills do not offer coupons. They are also called Non-coupon bonds or Zero-coupon bonds. These are not interest-bearing bonds.

- [* G-secs are issued by RBI on behalf of the Central government as well as state government whereas T-Bills are issued by RBI on behalf of the central government only]

- These T-Bills can also be traded in the market.

- They are also called as discounted securities. They are issued at discounted prices. For example- The face value of the bond is 100rs but it will be sold at 80 rs and after maturity the bond will be purchased at the original face value.

- Concept of T-Bill-Treasury bills are money market instruments issued at discounted rates and purchased at the original face value

- T- Bills are also called zero-coupon or non-coupon bonds.

- RBI issues T-bills on behalf of the central government

The topic for the next class:- Benefits of external benchmarking and other quantitative tools.